You may be more familiar with the concept by its previous incarnation when it was known in its simplest origins as being something of a timeshare. But in today’s world where “used” is now known as “previously enjoyed”, modern day parlance refers to it under its current moniker, “fractional ownership”. And just exactly what, and more specifically, to what extent, one can partake in a fractional ownership program has becomes an ever-growing list. While the original concept of fractional ownership described it as the usage and access to a luxury condominium or high-end resort hotel complex on a schedule of shared usage, today, an individual or group can be involved to varying degrees with a much broader range of items. These areas now include everything from varying levels of high-end resort and vacation properties, expensive works of art, varying methods of luxury transportation such as yachts, all types of aircraft, and motor homes, right down to various equine animals and even everyday house pets.

Sponsored Ads

To define it in its simplest terms, the concept of fractional ownership allows an individual or group a percentage share of an appreciable asset, with the shares being owned by varying numbers of partners. Without individual outright ownership, each partner enjoys predetermined privileges and priorities of the asset – be it one of a special usage rate, regular annual or holiday access as outlined in the original contract – as well as potential income sharing or profit upon the assets liquidity. In most instances, the fractional ownership asset in question is in turn then managed by a company or corporation on behalf of that ownership group, who are responsible to pay some degree of variable usage fees. To best understand exactly what fractional ownership is, imagine a large and expensive property that may be prohibitive to purchase and maintain on an individual basis.

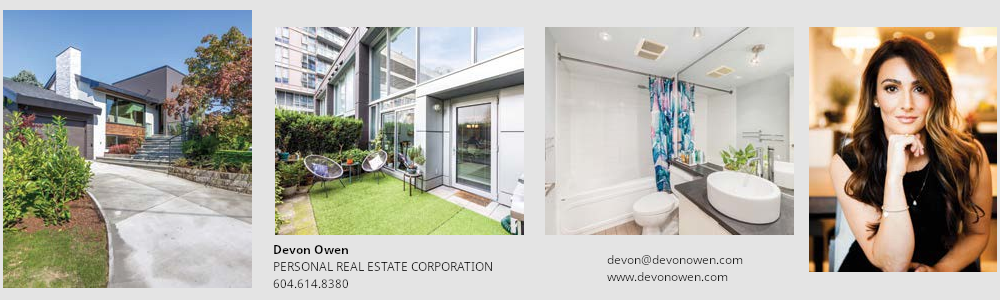

Instead of owning it outright, you purchase a share of the property along with a number of others. Not only do you then have access and the benefits, but as others are similarly involved, you share in the burden of maintenance and taxes. Among the broad panoply of offerings within the luxury or high-end property opportunities, The Ritz-Carlton Club Company is generally regarded as the established leaders in the fractional ownership industry. Boasting a roster of luxurious properties in a variety of locations including San Francisco, Aspen, Colorado, Kapalua Bay, Hawaii, Lake Tahoe, Nevada, St. Thomas in the U.S. Virgin Islands and South Beach, Florida, the Ritz-Carlton allows their clientele to enjoy all the benefits of a second home or resort destination with none of the responsibilities, all of which is further enhanced by the five-star luxury hospitality service for which their name as a premier hotel facility is known and respected.

Within the Ritz-Carlton fractional ownership family, a member is afforded the flexibility to stay at the entire portfolio of distinctive luxury properties. While the concept was perhaps largely established in exotic locales both in the United States and abroad, fractional ownership properties now dot the landscape in an ever-growing number of areas. Canada has certainly seen its share of offerings expand all across the country. Starting primarily within the cottage country regions of Muskoka Lake in Southern Ontario, fractional ownership can now be enjoyed in areas stretching across the nation, from resort areas along British Columbia’s Sunshine Coast all the way east to Queens County, Nova Scotia and the Humber Valley Resort on Canada’s Atlantic Coast.

Ontario’s Taboo Resort in Gravenhurst offers their residents two fractional ownership possibilities; representing 13 weeks annually or 1/5, which in turn calculates to 10 weeks. Chief among Taboo’s main selling points is a beautiful and challenging 7200 yard home golf course. Considered the Number One course in all of Ontario, it was carved from the Canadian Majestic Shield and designed by native son and 2003 Masters Champion Mike Weir. British Columbia is similarly represented with varying fractional ownership programs offered in locations around the Province such as the Poets Cove Resort and Spa on Pender Island, the Pacific Shores Resort and Spa in Parksville, the Spirit Ridge Vineyard Resort in Osoyoos, and the Royal Private Residence Club in Kelowna. Located next to the Grand Okanagan Lakefront Resort on the scenic Okanagan Lake, the Royal Private Residence Club is among Canada’s most sought-after locations. Outfitted with a restaurant, fitness centre, spa and swimming pool, twenty golf courses are available within the immediate vicinity, along with two internationally acclaimed ski resorts; Big White and Silver Star. The popularity of the term fractional ownership has given cause to many collateral industries where similar concepts, such as real estate timeshares were established and thriving. In the world of resort accommodation, time share percentages can be as much as one quarter or as little 1/26 or two weeks annually.

Sponsored Ads

But while the idea may have germinated in the ranks of the real estate world, fractional ownership has expanded well beyond. Take for example, the concept of “Flexpetz”. This company provides members with local access to a variety of breeds of dogs, all of who were rescued or “re-homed”, very lovable, well groomed and maintained and fully trained. Based on public demand, this unique service was created for today’s busy working professional who loves and craves the companionship of a dog, but whose time constraints and or travel schedule preclude them from being a full-time pet owner.

Flexpetz members can devote anywhere from just a few scant hours, to a number of consecutive days with their roster of pets, with local drop-off and collection to ones home or office throughout their various locations. And if that weren’t convenient enough, with expansion plans to soon include New York City, London, England and Tokyo, Japan, the Flexpetz program is similarly transferable, allowing you the option to spend time with another pet in another city.

In the world of high-end transportation, fractional ownership grew exponentially in the area of corporate business jets. In 1986, NetJets pioneered the concept of fractional jet ownership, giving the business person or business owner all of the benefits and convenience of actual aircraft ownership, but at a fraction of the cost. In short, NetJets hires the pilots, maintains the planes and attends to the specific flight logistics, while providing a dedicated owners services team. As a fractional aircraft owner, you actually purchase, finance or lease an undivided interest in a specific, serial-numbered aircraft, with the size of the interest directly proportional to the number of hours you typically fly in a year. A 1/16 ownership represents the smallest share and is the equivalent of 50 hours of flying per year in a Hawker 400XP.

The 1/16h fractional interest starts at about $450,000 annually in addition to a one-time acquisition cost based on the interest size desired as a fraction of the total value of the aircraft type. Today, NetJets ranks as the worldwide leader in fractional aircraft ownership. In the more than two decades since their inception, they have amassed over 670 aircraft thus making it the largest fleet of light, mid-size and large cabin aircraft while boasting the most fractional owners. Not surprisingly, given the extent to which fractional ownership can be applied, there has been tremendous growth in the area of sport and luxury vehicles.

This unprecedented growth spurt now allows the consumer to enjoy the exhilaration derived from an impressive roster of high-end vehicles such as Ferrari, Lamborghini and Aston Martin. When individually, the costs associated with such luxurious modes of transportation can be rather costly and often result in the vehicle spending inordinate amounts of time in storage. But the question remains, despite the rapid growth it’s enjoyed, is the idea of a time-shared asset of benefit to all those involved?

The debate has most believing that fractional ownership has more than its fare share of advantages. In terms of air travel, there appear to be infinitely more opportunities to divide the asset for the shared consumers, allowing a certain degree of flexibility and convenience, without the inherent headaches that often befall a sole owner of such an expensive endeavor. In the high end luxury resort areas, most private residences have clubs that offer many exclusive amenities, the kind you’d be hard pressed to find in a wholly- vacation home or condo.

Many such resorts offer such extras as providing optional grocery shopping services for your visit, taking care of your personal dry cleaning needs, and even having your individual pictures and mementoes displayed for your arrival. In other words, not you’re ordinary second home. Fractional ownership provides a myriad of new and exciting opportunities to the consumer. Given the tremendous growth it has enjoyed thus far, one can only imagine what that list of shared possibilities will contain in the near future