Is Vancouver real estate really in crisis? A look behind the headlines.

Recent media stories have trumpeted a major slowdown in residential real estate sales in Metro Vancouver. While the volume of sales has indeed dropped slightly this past year, the good-news story behind the headlines is that property values in Metro Vancouver continue to hold. Although some asking prices may be slightly lower today than they were a year ago, one would be hard-pressed to find a residential real estate transaction in Vancouver in which the seller lost money on the sale.

To fully appreciate today’s Lower Mainland real estate market, it’s important to remember the steep rise in prices we’ve seen over the past ten years. According to RE/MAX, average home prices have risen from $287,000 in 1997 to $570,000 in 2007: an appreciation of almost 99% in just a decade. And though it is true that in July 2008 we experienced a 44% drop in total sales

compared to July 2007, it is also true that the average home price is up over 5% from a year ago. According to Landcor Data Corporation, median residential real estate prices in BC were $46,668 higher in the first half of 2008 than they were in the same period in 2007. Metro Vancouver is still the most expensive real estate market in the country. And although price gains will be smaller this year than in many years, prices all parts of Canada are still projected to set records.

Sponsored Ads

We may see asking prices dropping in the next six to twelve months, but that is just a sign of sellers’ expectations becoming normalized. This is a far cry from the situation in the United States, where residential real estate sales and prices are both in steep decline. While some analysts have pointed to the American crisis and argued that their problems are bound to become ours in the near future, the reality is that U.S. economic fundamentals bear little relation to the same fundamentals in Canada. The United States is the most publicly and privately indebted country in the Western world and its citizens have the lowest levels of personal savings.

The mortgage and subsequent real estate crisis in the United States was a product of these weak fundamentals; banks and lenders were finally forced to accept the reality their thousands of no-capital loans amounted to nothing more than a financial house of cards. In Canada, our economic fundamentals remain strong and show no signs of weakening in the near future, especially not here on the West Coast. Canada still enjoys one of the lowest debt-to-GDP ratios in the world and as a result our interest rates remain not only highly competitive but enviable. British Columbia also leads the nation in employment growth, currently ranking at 3.4%.

A recent report by Merrill Lynch expects incomes in our province to continue to rise. And our population (currently 4.4 million) is expected to increade by 1% or more in the next ten years—that’s 44,000 new British Columbians who will need a place to live. We’re already feeling the impact of immigration on our current rental stock. When combined with our strong economic.

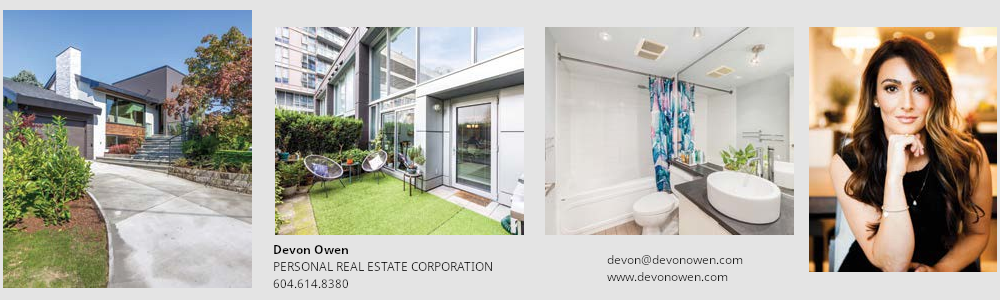

fundamentals, this continuing migration to BC has led economists from all sectors to predict that housing prices will continue to hold in the future, despite the overall slowdown in sales. The reality of the Lower Mainland’s real estate market has not changed. Location is still the ultimate key to real estate values, and the physical constraints of Metro Vancouver—bounded as we are by the ocean, mountains, and US border—have not changed. The constraints of our geography means greater density and a continued upward trend in housing prices over time.

And Vancouver is not only a prime location year after year we are recognized internationally as one of the best places in the world to live. The 2010 Vancouver/Whistler Olympic Winter Games are already begin to attract the intense scrutiny of the international media; for a place that’s already the envy of the world, what effect do you suppose a $5 billion Olympic marketing campaign is going to have on people’s desire to live here? The truth behind the headlines is only this: the current slowdown in overall real estate sales is only an indicator of a reasonable level of caution among consumers. The demand for housing remains strong—consumers are merely taking a decent amount of time to evaluate and consider their potential home purchase.

The normalization of our once searing-hot market has actually given consumers the opportunity to ask the questions they should always ask when buying real estate, but may not have had the luxury to do a year ago. For example: are you considering buying property as an investment, or a place to live? In either case your purchase represents a lifestyle choice,

Sponsored Ads

so consider not just the proximity of shops and schools but which value-added features the builder or developer is willing to include. If you’re looking for a property built to a higher standard of environmental sustainability, take advantage of this period in the market to ask builders and developers about such green features as geothermal heating and cooling, which they may include in their offering.

These forward-thinking features not only contribute to a better world, they add to the long-term equity of the property through cost savings on energy use. If you’d like to spend more time taking advantage of Greater Vancouver’s mild climate, take this opportunity to shop around for a property with the right proportion of indoor and outdoor living space. Do you want to be able to exercise, study or entertain in your building? Many building developers have taken purchasers’ live/work/play ethos to heart and have begun to include amenities that offer a new range of possibilities for entertainment and relaxation.

This period in the real estate market offers consumers the perfect opportunity to take their time before making a purchasing decision—to research that they’re buying from a reputable builder, that their property is a quality product and located in an area where people will want to live in years to come, and that it’s the right purchase for them. So is now the right time to buy in Greater Vancouver? The simple answer is yes. Buy now, buy right and buy for the long term.

Hani Lammam is the Vice President of Development for Cressey Development Group. In Janurary 2008 he was named one Business in Vancouver’s “Top 40 Under 40.”